net investment income tax 2021 trusts

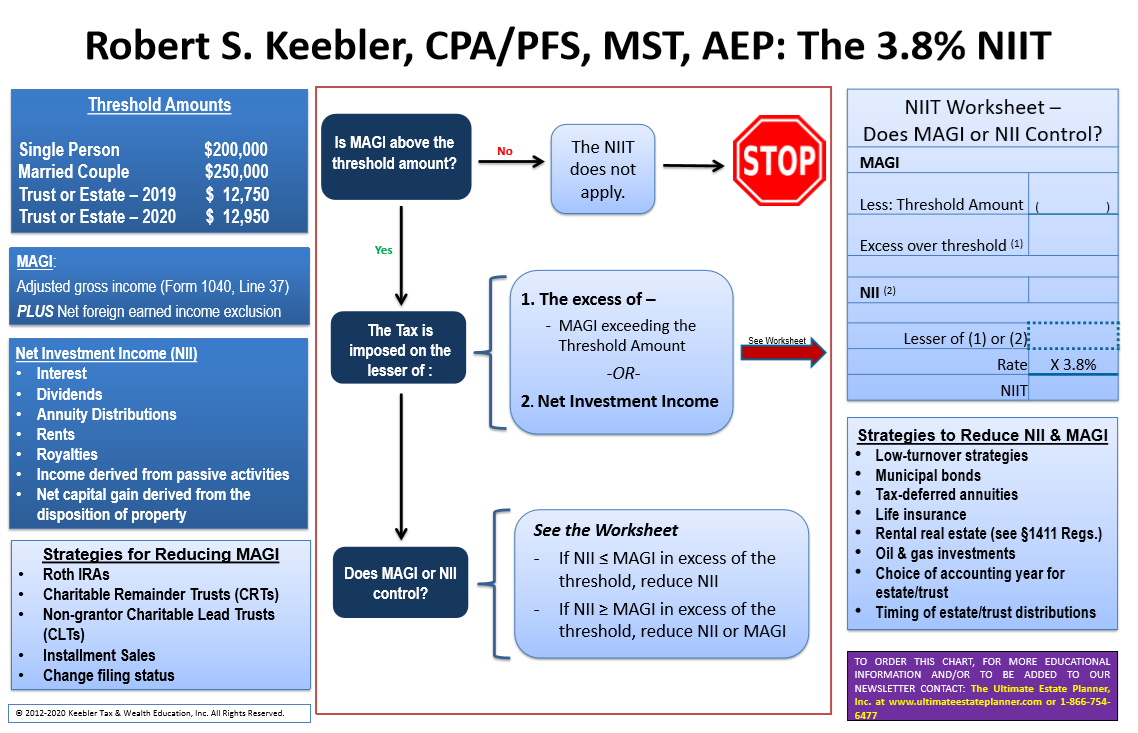

16 Deferred non-commercial business losses 2021. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021.

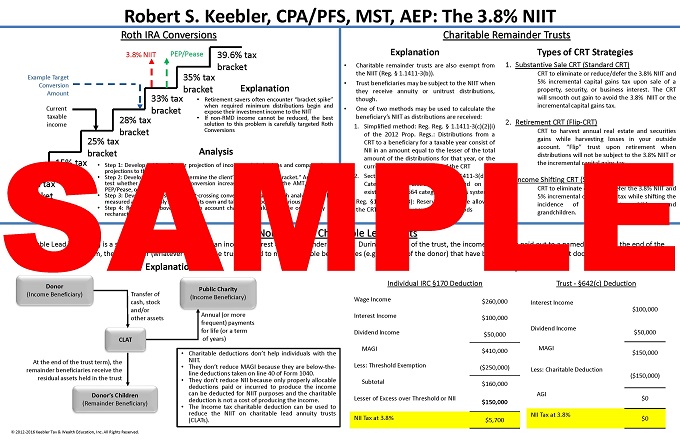

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

For the three months ended June 30 2022 and 2021 net income available for.

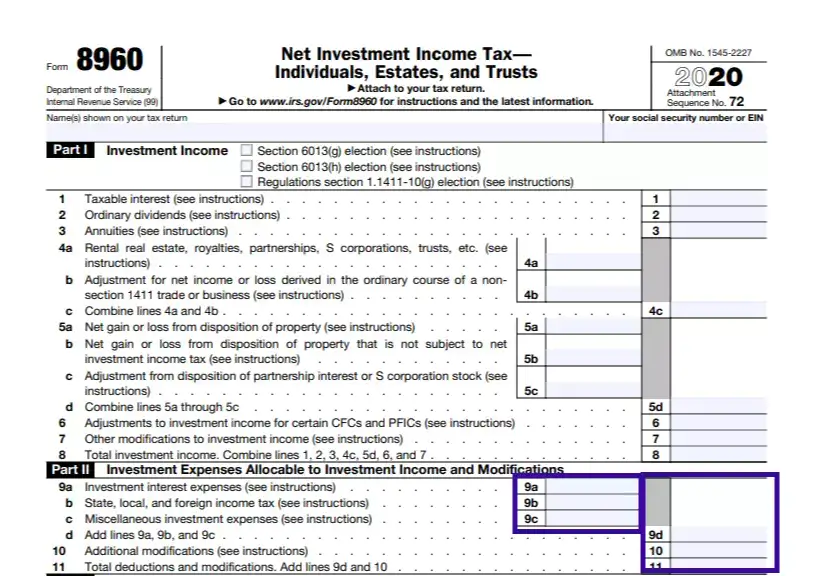

. Generally net investment income includes gross income from interest dividends annuities and royalties. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US. The GST tax exemption amount which can be applied to generation-skipping transfers including those in trust during 2021 is 117 million increased from 1158 million in.

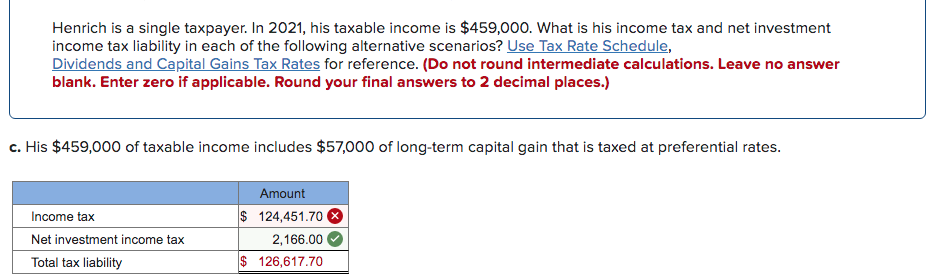

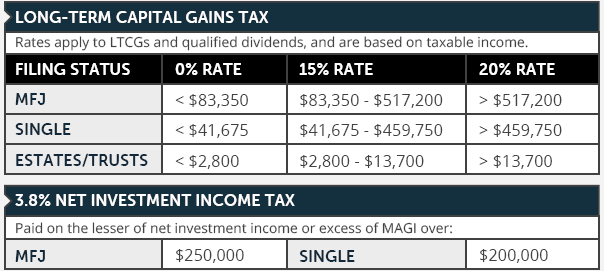

Qualifying widow er with a child 250000. A number of funds have earned 4- and 5-star ratings. 2022-01-07 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts.

April 28 2021 The 38 Net Investment Income Tax. Ad Our funds have star power. FRT today reported operating results for its second quarter ended June 30 2022.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT. Summary of HR8323 - 117th Congress 2021-2022. Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank.

Here the 5000 of capital gain excluded from DNI clearly net investment income is added to the 22500 of net investment income. The individual tax. 7 - Salary deferrals 401k 403b etc can reduce MAGI for the 38 surtax but cannot reduce earned income for the 09.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service. Income Tax Return for Estates and Trusts Schedule G Line 4.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends taxable interest rents royalties certain income from trading commodities taxable income from investment annuities REITs and master limited partnerships and. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related expenses.

Free 2-hour Trading Workshop and Lab our investing QuickStart Kit Stock Picks more. To amend the Social Security Act and the Internal Revenue Code of 1986 to include net investment income tax imposed in the Federal Hospital Insurance Trust Fund and to modify the net investment income tax. The statutory authority for the tax is.

Net Investment Income Tax - Individual Estates and Trusts 2021 Form 8960 Form 8960 Department of the Treasury Internal Revenue Service 99 Net. Federal Realty Investment Trust NYSE. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Strategies Across the Risk and Reward Spectrum. Ad Access Our Thought Leadership for Articles and Special Reports on Asia.

Explore funds and choose those that align with your clients goals. Ad Live hands-on investing workshop that will forever change how you look at the market. An additional Medicare tax of 09 also applies to earned income subject to employment taxes.

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Taxcycle T3 Trust Returns Taxcycle

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Aca Tax Law Changes For Higher Income Taxpayers Taxact

Maximizing The Investment Interest Deduction

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate The Net Investment Income Properly

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Net Investment Income Tax Niit Quick Guides Asena Advisors

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

How To Build A Tax Efficient Taxable Account As A Physician Wealthkeel Advisors Llc

How To Calculate The Net Investment Income Properly

What Is The Net Investment Income Tax Caras Shulman

Irs Form 8960 Fill Out Printable Pdf Forms Online